The Malaysian government has issued its first ringgit-denominated sustainability Sukuk worth RM4.5 billion (US$968.5 million) on the 30th September 2022. The proceeds from the 15.5-year Sukuk facility will be utilized to finance or refinance eligible social and green projects as defined in the Malaysian government’s SDG Sukuk Framework.

“The issuance will enable Malaysia to not only meet its commitments as a responsible nation and signatory to the Paris Agreement, but also further its efforts to advance its people’s socioeconomic well-being,” Tengku Zafrul Aziz, the Malaysian finance minister, said in a statement. The Sukuk facility was issued via the Malaysian Government Investment Issues (MGII) instrument. It was offered via the first sustainable MGII issuance, which was announced in the 2022 Malaysian budget.

The facility is the government’s first ringgit sustainability Sukuk, and more could potentially follow. About a week before the debut issuance, Tengku Zafrul revealed at an event that the government will issue up to RM10 billion (US$2.15 billion) in ringgit-denominated sustainability Sukuk starting in the fourth quarter of 2022.

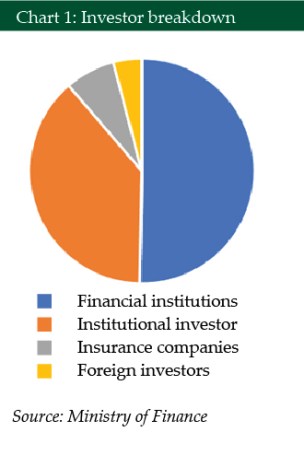

The offering was priced at a profit rate of 4.66% and was oversubscribed by 2.38 times. It received 355 bids with total bids of RM10.7 billion (US$2.3 billion) and a cut off rate of 80.34%. The issuance attracted investment from local financial institutions at 50.3%, institutional investors at 38.4%, insurance companies at 7.2% and foreign investors at 4.1%.

The finance minister further added that the issuance is a testament to the government’s efforts in advancing climate action and accelerating the transition toward achieving a prosperous, inclusive and sustainable nation, in accordance with the 12th Malaysia Plan.

|

Malaysia’s first sustaianbility ringgit Sukuk RM4.5 billion (US$968.5 million)  30th September 2022 |

|

| Summary of terms and conditions | |

|

Issuer |

Malaysian government |

|

Size of issue |

RM4.5 billion (US$968.5 million) |

|

Mode of issue |

Competitive multiple price auction and private placement |

|

Purpose |

To finance or refinance eligible social and green projects as defined in the Malaysian government’s SDG Sukuk Framework. |

|

Tenor |

15.5 years |

|

Issuance price |

100% |

|

Profit rate |

4.66% |

|

Payment |

Semi-annual |

|

Currency |

Malaysian ringgit |

|

Maturity date |

31st March 2038 |

|

Principal dealer(s) |

Affin Islamic Bank, AmBank Islamic, Bank Islam Malaysia, CIMB Islamic Bank, Hong Leong Islamic Bank, Maybank Islamic, RHB Islamic Bank |

|

Governing law |

Malaysian law |

|

Islamic structure |

Murabahah |

|

Listing |

Bursa Malaysia’s Exempt Regime |

|

Underlying asset |

Shariah compliant commodities |

|

Tradability |

Yes |

|

Investor breakdown |

Local financial institutions 50.3%, institutional investors 38.4%, insurance companies 7.2%, and foreign investors 4.1% |